Rapid Growth of China’s Sensor Industry

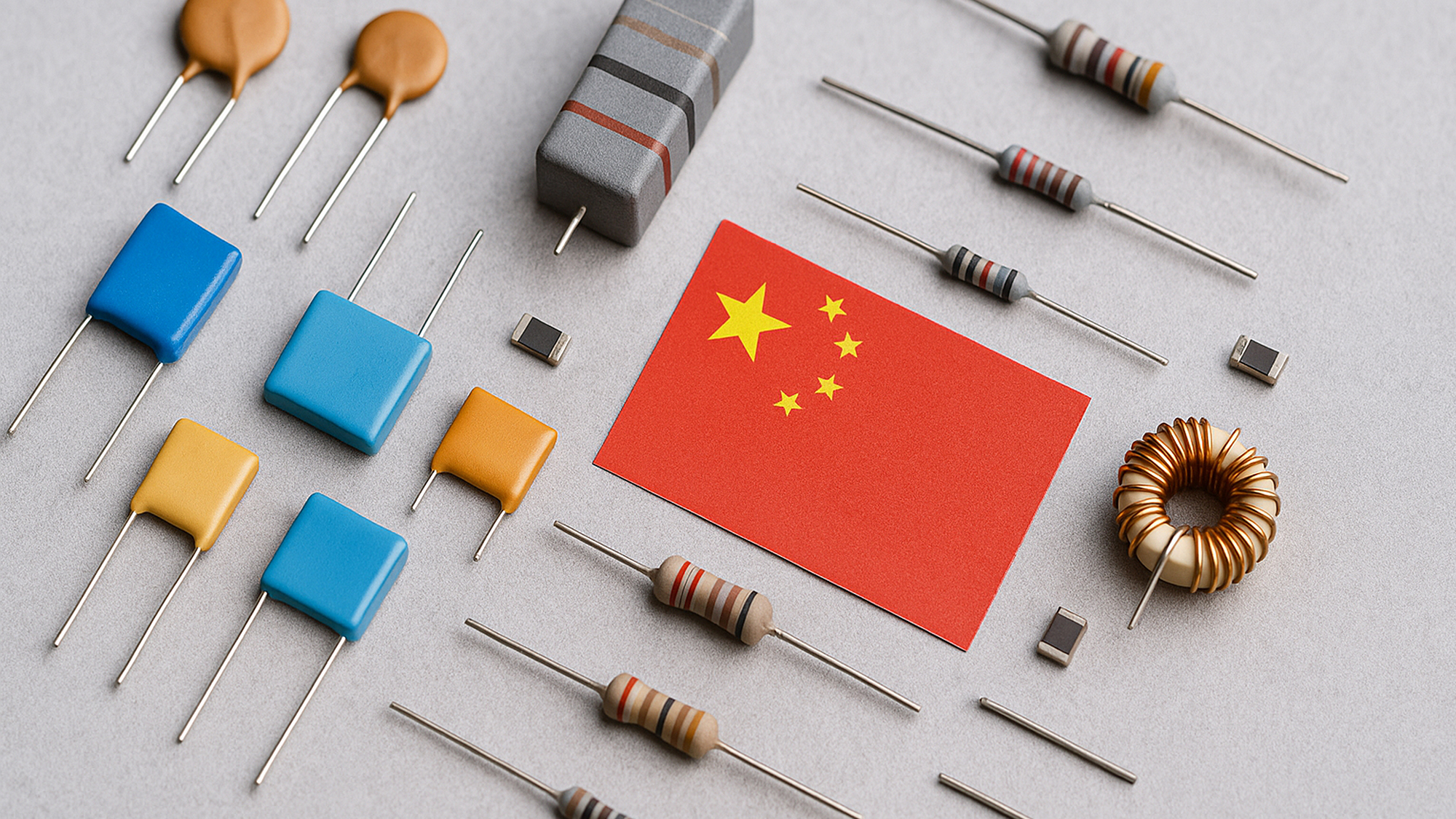

Sensors are the “eyes and ears” of modern electronics, converting real-world signals into data. In China, the sensor industry has grown explosively alongside markets like smartphones, IoT, and automotive. In 2023, China’s sensor market reached ¥364.5 billion, with a five-year CAGR of over 13%. It’s projected to exceed ¥414 billion in 2024 – a reflection of strong demand for everything from smartphone cameras to industrial pressure sensors.

Several leading Chinese sensor companies have emerged:

Will Semiconductor (韦尔股份): A Shanghai-based IC design company that is now one of the world’s biggest suppliers of CMOS image sensors, thanks to its acquisition of OmniVision. Will Semi’s revenues have surged, and by 2024 it was seeing significant profit growth. Its image sensors are used in countless smartphones (especially mid-tier phones globally) and security cameras.

Goodix Technology (汇顶科技): Known internationally for fingerprint sensors (they supplied the fingerprint chips for many Android phones). Goodix has expanded into other touch and biometric sensors and saw robust performance in 2024. They exemplify Chinese companies that have innovated and exported high-tech sensors (Goodix’s fingerprints were even used by top global smartphone brands).

SmartSens (思特威): A fast-growing CMOS image sensor startup from Shanghai, focusing on security and automotive imaging. It has gained traction as a homegrown alternative for surveillance camera sensors – a huge market in China – and is now eyeing automotive camera opportunities. SmartSens was among companies with strong revenue gains in 2024.

Hanwei Technology (汉威科技): A leader in gas sensors and environmental monitoring sensors. Based in Zhengzhou, Hanwei makes a variety of sensors (for detecting toxic gases, air quality, etc.) and IoT solutions, heavily used in industrial safety systems and smart city applications across China.

AVIC Optical & Electronic (中航光电) / AVIC Electromechanical: While primarily an aerospace/military supplier, they produce high-end sensor systems and precision measurement components. Their involvement underscores that even strategic sensors (for aircraft, satellites) are being indigenized in China.

Beyond these, innumerable smaller companies and startups populate the sensor landscape (over 20,000 registered companies as of 2024). Cities like Wuxi have become sensor industry hubs, with government support to create a domestic MEMS manufacturing base. Notably, foreign sensor firms (Bosch, Infineon, etc.) have local production in China, but here we focus on Chinese-owned entities.

Innovations and Breakthroughs in Sensor Technology

China’s sensor companies are not just growing in size; many are innovating in new domains:

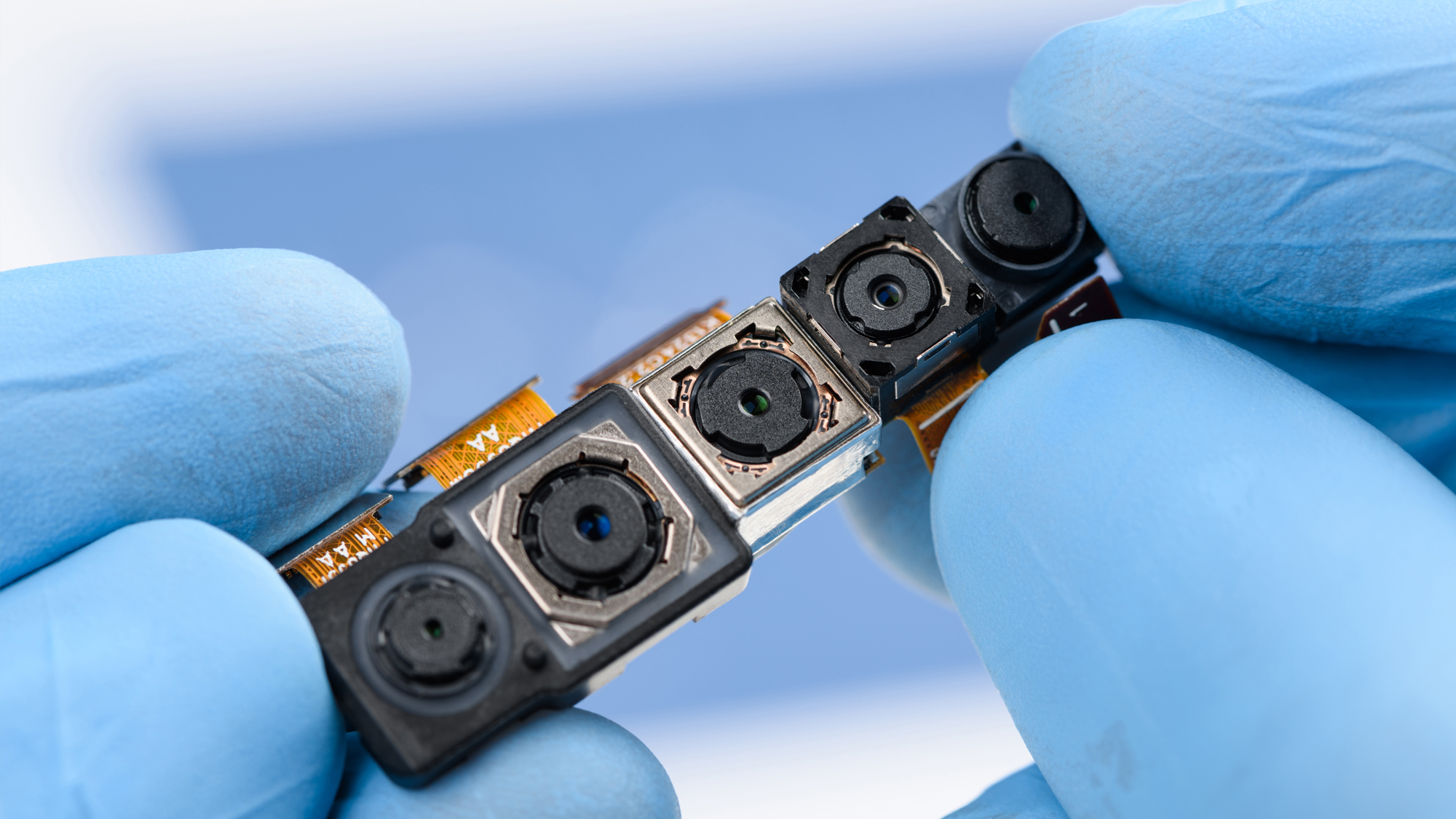

Image Sensors: With companies like Will Semi/OmniVision and SmartSens, China is at the forefront of CMOS image sensor development. They have designed high-resolution sensors for smartphone cameras and are now pushing into specialized areas – e.g. infrared imaging sensors for security and automotive night-vision. In 2022, SmartSens reportedly launched one of the first commercially available CMOS single-photon avalanche diode (SPAD) LiDAR sensors, aiming to enable low-cost 3D sensing for vehicles.

Automotive and LiDAR: The boom in autonomous driving has spurred Chinese LiDAR startups. Hesai Technology (禾赛) and RoboSense (速腾聚创) are two notable LiDAR makers. Hesai in particular has become a global leader – accounting for ~33% of worldwide automotive LiDAR sales in 2024 – and was the first to achieve profitable mass production of LiDAR. These sensors help provide 3D vision for self-driving cars and advanced ADAS, and Chinese units are now in vehicles of brands like Li Auto and others.

MEMS Sensors: China has been working on MEMS (Micro-Electro-Mechanical Systems) for things like accelerometers, gyroscopes, and microphones. Goertek (歌尔), known as an acoustics and VR device company, also produces MEMS microphones in huge volumes for smartphones and smart speakers. Local fabs (like Silex in Beijing, now owned by Navitas) can manufacture MEMS chips. We’re seeing domestic 6-axis IMUs and digital accelerometers enter the market, targeting IoT and automotive applications, though overseas players still dominate in top precision.

Sensor Fusion and Modules: Several Chinese companies now offer sensor modules and integrated solutions – for example, gesture recognition modules combining radar sensors with AI, or smart camera modules with onboard image processing (like those from Hikvision, Dahua, which integrate their own image sensor designs for surveillance use). The integration of sensors with edge computing is a trend where Chinese firms leverage AI expertise (SenseTime, Megvii, etc., though those are more software) to create complete systems.

It’s also worth noting that manufacturing equipment and materials for sensors are improving domestically. For example, China can now produce 8-inch MEMS wafers and has local packaging tech for MEMS, which historically were bottlenecks. This allows more of the sensor value chain to be within China, speeding development cycles.

Applications: From Automotive to Smart Homes

Chinese sensors are used across a broad spectrum of applications, often mirroring global trends but at immense scale domestically:

Automotive Electronics: Beyond LiDAR, Chinese-made millimeter-wave radar sensors (for adaptive cruise control, etc.) are emerging. Companies like Huawei (through its Intelligent Automotive unit) are developing 77GHz radar sensors and camera sensor systems for cars. The Chinese auto market’s shift to smart EVs creates huge demand for sensors (ultrasonic parking sensors, interior driver monitoring cameras, tire pressure sensors). While many car sensors are still imported, local production is ramping up quickly with joint ventures and independent efforts.

Industrial & Infrastructure: China’s push for industrial automation and smart cities means thousands of sensors deployed in factories and urban infrastructure. You find Chinese pressure sensors, flow sensors, and vibration sensors in factory equipment, power plants, and pipeline monitoring. State-owned firms and academia have collaborated to produce high-end sensors (for instance, earthquake detection seismometers, high-precision pressure sensors for aerospace) within China.

Consumer Electronics & IoT: Smartphones from Chinese brands (Xiaomi, Oppo, etc.) increasingly use domestically sourced components. For example, OmniVision (owned by Will Semi) image sensors appear in many phones’ front-facing cameras. Additionally, the explosion of IoT devices – smart locks, appliances, wearables – benefits Chinese sensor suppliers. Proximity sensors, fingerprint sensors, and environmental sensors (humidity, CO₂, etc.) from local sources are common in devices sold in the Chinese market, and some of those devices are exported.

Healthcare Devices: An emerging area – medical and wearable sensors. While China still imports many critical medical sensors, there’s movement in things like infrared temperature sensors, blood oxygen sensors, and ECG patches. During COVID, Chinese-made IR sensors (for thermal thermometers) were shipped worldwide due to shortage, showcasing capability when scaled. Companies like LifeSense and others are developing biomedical sensors for home health gadgets.

By application share, automotive electronics account for about 24% of China’s sensor usage, industrial 22%, telecom 19.6%, consumer electronics ~18%, and medical ~10%. This diversified demand ensures the sensor industry isn’t reliant on a single sector.

Buyer Considerations and Sourcing Strategy for Sensors

For international buyers and engineers considering Chinese sensor components or modules:

Performance vs Price: Chinese sensor products often come at a lower price point. For instance, a Chinese image sensor or LiDAR might be significantly cheaper than a Western counterpart. Evaluate if the performance meets your needs – in many cases, these sensors are “good enough” for mass-market applications, even if they slightly trail the absolute top performers. Always check specs like signal-to-noise ratio, temperature range, lifespan, etc., against your requirements.

Supply Stability: Sensors can be subject to supply crunches (e.g. image sensors had shortages in recent years). Chinese suppliers, with their large capacity, can sometimes fulfill orders when others cannot. However, be mindful of any trade restrictions – e.g., certain high-end camera sensors for defense use might face export license requirements. For most commercial sensors, this is not an issue. It’s wise to maintain multiple sources if possible (dual-source a critical sensor with one Chinese and one non-Chinese vendor) to hedge geopolitical risks.

Quality and Calibration: Higher-end sensors often require calibration (for example, camera sensors need tuning, or MEMS sensors need bias calibration). Ensure that if you adopt a Chinese sensor, you have access to the necessary algorithms or support for calibration. Larger companies like Will Semi/OmniVision have field application engineers (FAEs) who can assist overseas clients. For smaller companies, you might work through a distributor or partner who can interface with the factory’s engineering team. Don’t skip on testing the sensor thoroughly in your system; Chinese manufacturers will typically provide evaluation kits or demo boards to help with this.

Localization and Support: Language and distance can be a challenge, but many Chinese sensor firms have international offices now (Will Semi has inherited OmniVision’s global network, Goodix has offices in Europe/US, Hesai has a U.S. office after its NASDAQ IPO). Utilize these when available for smoother communication. Also consider time zone differences for support; having a local distributor can mitigate this, as they can provide frontline support and then liaise with the China HQ.

IP and Alternatives: In some cases, Western companies worry about IP when integrating Chinese modules (especially if it involves software or firmware from China, like in certain smart camera modules). Review the product for any security concerns – e.g., if using a Chinese IoT module, ensure it complies with your cybersecurity requirements or consider using your own firmware. Pure hardware sensors generally pose minimal IP risk, but modules with computing might. As always, if necessary, consult legal/export experts if you’re in a sensitive industry.

Overall, buyer sentiment is gradually shifting. International procurement teams, once hesitant, are now acknowledging that Chinese sensor suppliers offer professional-grade products and are often the only ones who can meet huge volume needs quickly. The success of companies like Hesai globally and the strong financials of firms like Will Semi and Goodix show that Chinese sensor tech can compete commercially. For buyers, this translates into more choice and leverage.

Call to Action: Keep Chinese sensor vendors on your radar. If you’re designing a device with cameras, consider evaluating an OmniVision sensor alongside Sony or Samsung – you might be pleasantly surprised by the quality for cost. If you need LiDAR or radar for robotics or vehicles, look at Hesai or RoboSense solutions as they are now proven at scale. By engaging with China’s sensor industry, you’re tapping into an innovative and fast-moving field that can provide the building blocks for smart, connected products at competitive costs. In the IoT era, that could be the edge you need.