Dominance of Chinese PCB Production

Printed Circuit Boards are the foundation of electronic devices, and China is the PCB powerhouse of the world. Since overtaking Japan in 2006, mainland China has become the #1 PCB producer by output. As of 2023, 51% of global PCB products were made in China, reflecting the country’s central role in this industry. The Chinese PCB sector spans everything from low-cost single-layer boards to high-layer-count server and telecom backplanes.

Several factors contribute to China’s dominance: a complete supply ecosystem (laminates, components, assembly are all nearby), economies of scale in massive PCB factories, and continuous investment in modern equipment. Major Chinese PCB manufacturers – such as Shennan Circuits (深南电路), DSBJ (东山精密), Kinwong (景旺电子), and Victory Giant Tech – rank among the top PCB companies globally. They serve a wide range of industries, including consumer electronics, communications infrastructure, automotive electronics, and industrial equipment.

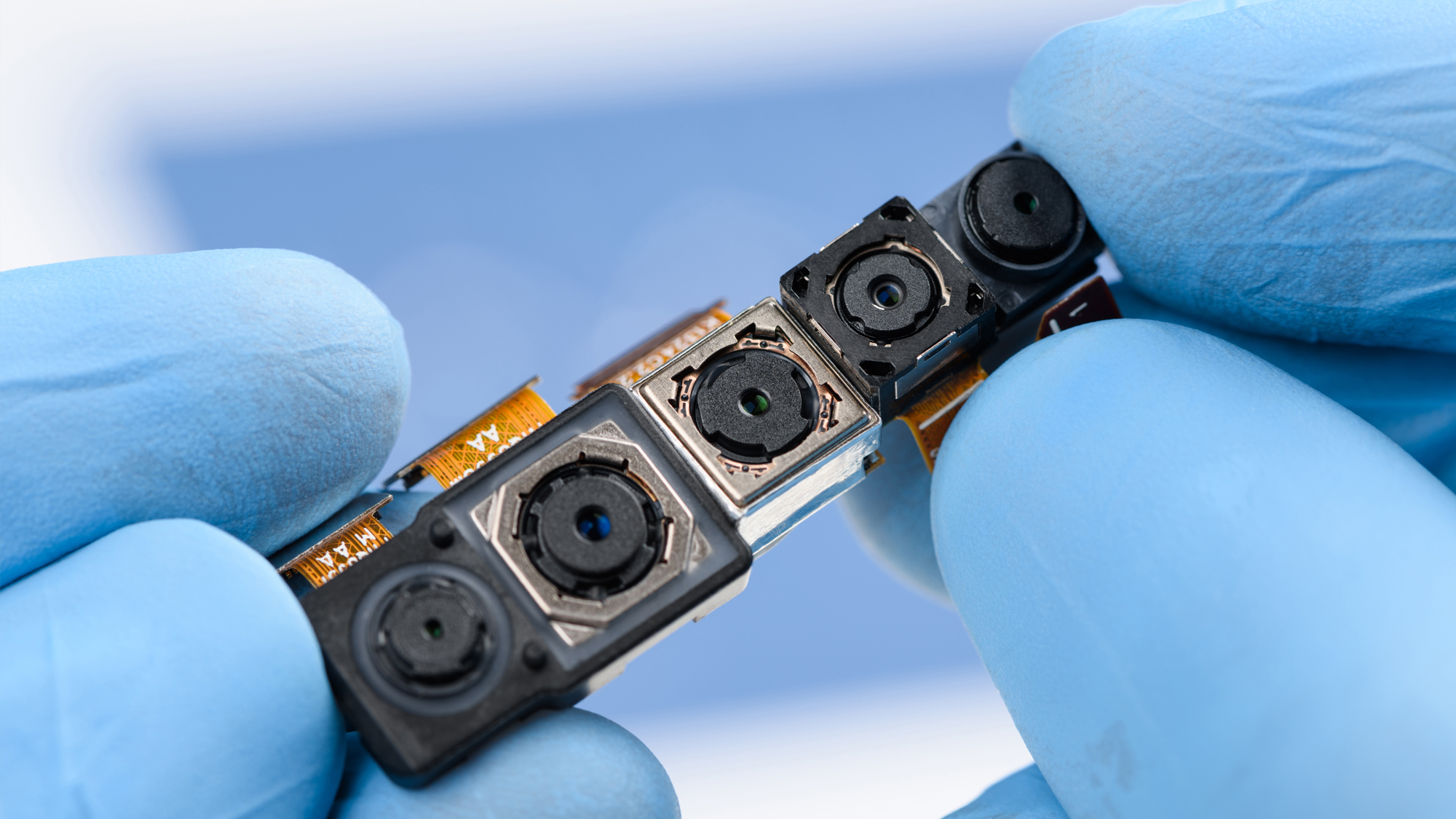

Notably, Chinese PCB firms are increasingly producing high-end PCBs that require advanced processes (HDI boards for smartphones, RF boards for 5G, IC substrate-like PCBs for chip packaging, etc.). For example, local suppliers now manufacture complex multilayer boards for EV battery management systems and 5G base stations, which demand precision and reliability.

Technological Advancements and Capabilities

In recent years, Chinese PCB makers have invested in technology upgrades to meet evolving demands:

High Layer Count & HDI: Factories in China routinely fabricate boards with 8, 10, or more layers, and have mastered High-Density Interconnect (HDI) techniques for fine trace and via features. This enables production of smartphone logic boards, high-speed server boards, and other complex designs domestically.

Flexible and Rigid-Flex PCBs: With the growth of wearables and compact devices, Chinese manufacturers have adopted flexible PCB tech. Companies like Dongguan Multek and others produce flexible and rigid-flex circuits used in cameras, foldable phones, and IoT gadgets.

Advanced Materials: Chinese PCB companies work with cutting-edge materials (e.g. Rogers high-frequency laminates for radar, polyimide for flex, metal-core for LED lighting) to serve specialized needs. There is also a push to develop domestic PCB substrates equivalent to Japan’s and Taiwan’s for high-frequency and high-speed applications.

Automation and Smart Manufacturing: Leading PCB factories in China are implementing Industry 4.0 practices – using AOI (automated optical inspection), robotic plating lines, and MES (Manufacturing Execution Systems) to improve yield and consistency. This results in more reliable boards at large scale.

PCB Prototyping Services: China has popularized rapid PCB prototyping with services like JLCPCB, PCBWay, etc., which allow engineers worldwide to order small batch PCBs at very low cost and quick turnaround. This has made China a go-to source even at the prototype stage for startups and makers, fostering a global dependency on Chinese PCB infrastructure.

Global Supply Chain Shifts and “China+1”

Geopolitical and logistical factors are prompting adjustments in PCB supply chains. Some Western OEMs have adopted “China+1” strategies, looking to diversify PCB sourcing to other countries (like Vietnam, Thailand, India) in case of disruptions. Dell and HP, for instance, have asked their suppliers to add PCB production capacity outside of China by 2024 as part of broader risk mitigation.

Chinese PCB companies have responded proactively. At least 27 mainland Chinese and Hong Kong-invested PCB manufacturers have established operations in Thailand by the end of 2024. Thailand has become a preferred overseas hub where Chinese firms like Victory Giant and others set up PCB factories. This allows them to continue serving international customers who prefer a non-China production base, while leveraging Chinese engineering know-how. In effect, the “red supply chain” is extending globally, following client needs.

Despite some production moving offshore, China itself remains irreplaceable in the PCB realm. Prismark forecasts show China will continue as the largest PCB manufacturing base through 2028, even if its growth rate (around 4.2% CAGR) is slightly lower than emerging regions due to an already massive scale. The sheer capacity and expertise concentrated in the Pearl River Delta (Shenzhen, Dongguan) and the Yangtze River Delta (Suzhou, Wuxi) mean that for high-volume and advanced PCBs, China is hard to beat on cost-quality balance. Moreover, many Southeast Asian PCB factories are Chinese-owned, so the technology and process standards are essentially extensions of China’s industry.

Sourcing Quality PCBs: Tips for Buyers

For procurement teams, sourcing PCBs from China offers great advantages but also requires due diligence. Here are some considerations:

Select Reputable Suppliers: Work with established PCB manufacturers that have ISO9001, ISO/TS 16949 (for automotive), or other relevant certifications. Top-tier Chinese PCB firms often have decades of experience and supply to Fortune 500 electronics companies, indicating robust quality systems. Performing audits or using known contract manufacturers can help vet quality.

Lead Times and Flexibility: China’s PCB industry is extremely fast. Prototype orders can be turned in days, and high-volume orders benefit from efficient logistics. However, during peak seasons (around Chinese New Year or electronics production cycles), lead times can extend – plan and communicate forecasts with suppliers. Many factories operate 24/7 and can scale quickly if you need to surge production.

IP Protection: When sending PCB design files (Gerbers) to any external supplier, IP is a consideration. Reputable Chinese PCB houses will respect NDAs and protect your design data. Still, if the design is sensitive, consider using a trusted intermediary or splitting critical circuit portions across different suppliers. Thankfully, many Chinese PCB vendors have a long history in OEM partnerships and understand Western IP concerns, often with stricter data controls in place now to attract overseas clients.

On-site Inspections and Testing: Utilize the option of source inspections. Many buyers send their engineers (or third-party inspectors) to Chinese factories for first-article inspection or periodic audits. Additionally, request test coupons and quality reports (e.g. impedance test, cross-section analysis) with your PCB shipments for assurance.

Leverage Supplier Engineering: Chinese PCB vendors typically offer excellent engineering support. They can suggest design for manufacturability (DFM) improvements, material choices for better performance, or cost-down options. Engaging early with their engineers can optimize your design and avoid fabrication issues. This collaborative approach often speeds up development and reduces iteration.

Buyer’s Perspective: Cost and Reliability

Chinese PCBs are generally cost-effective – often 20–30% cheaper than equivalents from other regions, due to scale and supply chain efficiencies. This cost advantage can significantly impact product BOM, especially for complex boards where Western fabrication costs are high. Buyers should capitalize on this, but also ensure reliability isn’t compromised. Fortunately, the quality from leading Chinese PCB fabs is on par with global standards, as evidenced by their widespread use in automobiles, data centers, and even aerospace (China’s space program relies on domestic PCBs, indicating high reliability).

Be mindful of tariffs or trade policies that might affect PCB imports. In recent years, certain electronics tariffs have been imposed by the US on Chinese-made PCBs. Strategies like using Chinese PCB factories’ overseas branches (in Thailand or elsewhere) or classifying products under non-tariff codes can help mitigate extra costs if needed.

Call to Action: If you are designing or manufacturing electronics, it’s almost certain that Chinese PCB suppliers can add value to your supply chain. Evaluate your current PCB sourcing – are you getting the best mix of cost, quality, and lead time? Consider reaching out to a top Chinese PCB manufacturer for a quote or sample. Even if you adopt a China+1 strategy for resilience, keeping China in your PCB vendor list is wise given its unparalleled capability. By staying informed on Chinese PCB industry trends, you’ll make more strategic sourcing decisions and ensure your products benefit from the best the global market has to offer.