Domestic Chip Giants and Emerging Players

China’s semiconductor landscape features leading foundries and a vibrant fabless sector. SMIC (Semiconductor Manufacturing International Corp.) and Hua Hong Semiconductor are the top domestic fabs, capable of manufacturing mainstream logic chips. SMIC made headlines by producing a cutting-edge 7nm chip for Huawei’s flagship smartphone, demonstrating a leap in China’s capabilities under sanctions. In design, companies like HiSilicon (Huawei), Unisoc, and new AI chip startups (Biren, Cambricon) are pushing advanced IC development – though their production often relies on foundries like SMIC or overseas fabs.

Key players include:

SMIC (中芯国际), China’s largest contract chipmaker. In 2023, SMIC successfully fabricated a 7-nanometer Kirin 9000s processor, integrating 5G capabilities on a 7nm node. Analysts noted this as proof that SMIC achieved decent yields on 7nm even without EUV lithography, a significant milestone for Chinese foundries.

YMTC (长江存储): A leading NAND flash memory producer. Despite U.S. export curbs, YMTC launched an advanced 232-layer 3D NAND chip in 2023. TechInsights confirmed these chips in consumer SSDs, with record-high bit density, matching top-tier competitors. This breakthrough signals China’s ability to compete in memory technology.

ChangXin Memory (CXMT 长鑫存储): China’s domestic DRAM manufacturer, now mass-producing DDR4 and developing DDR5. CXMT has steadily shrunk process nodes (around 17nm-class), working to close the gap with Samsung, SK Hynix, and Micron.

Fabless Innovators: Companies like Unisoc (紫光展锐) – which held ~15% of the global smartphone SoC market in 2023 – and GigaDevice (兆易创新) for microcontrollers and NOR flash, are providing Chinese-designed chips for mobile, IoT, and consumer electronics. These fabless firms often partner with foundries in China and abroad to fabricate their designs.

Technology Milestones and Breakthroughs

Chinese semiconductor firms have recorded several notable technology milestones recently:

7nm and Advanced Nodes: The Huawei Kirin 9000s chip produced by SMIC in 2023 was a landmark – it’s manufactured at roughly 7nm (SMIC’s N+2 node) and restored 5G functionality to Huawei phones. This accomplishment – achieved under tight export controls – suggested that China “has solved 7nm yield issues,” according to industry experts. While still a couple of generations behind the latest 3–4nm chips, it narrows the gap and provides a foundation for future nodes.

Memory Density Records: YMTC’s 232-layer QLC NAND flash chip features the highest bit density seen in a commercial SSD by late 2023. With 19.8 Gb/mm² and over 200 active word-lines, it slightly surpasses peers (Samsung’s 236-layer, SK Hynix 238-layer, etc.). This indicates Chinese manufacturers can innovate at the cutting edge of 3D NAND stacking. Moreover, reports suggest YMTC is already trialing even higher layer counts (e.g. 256L+).

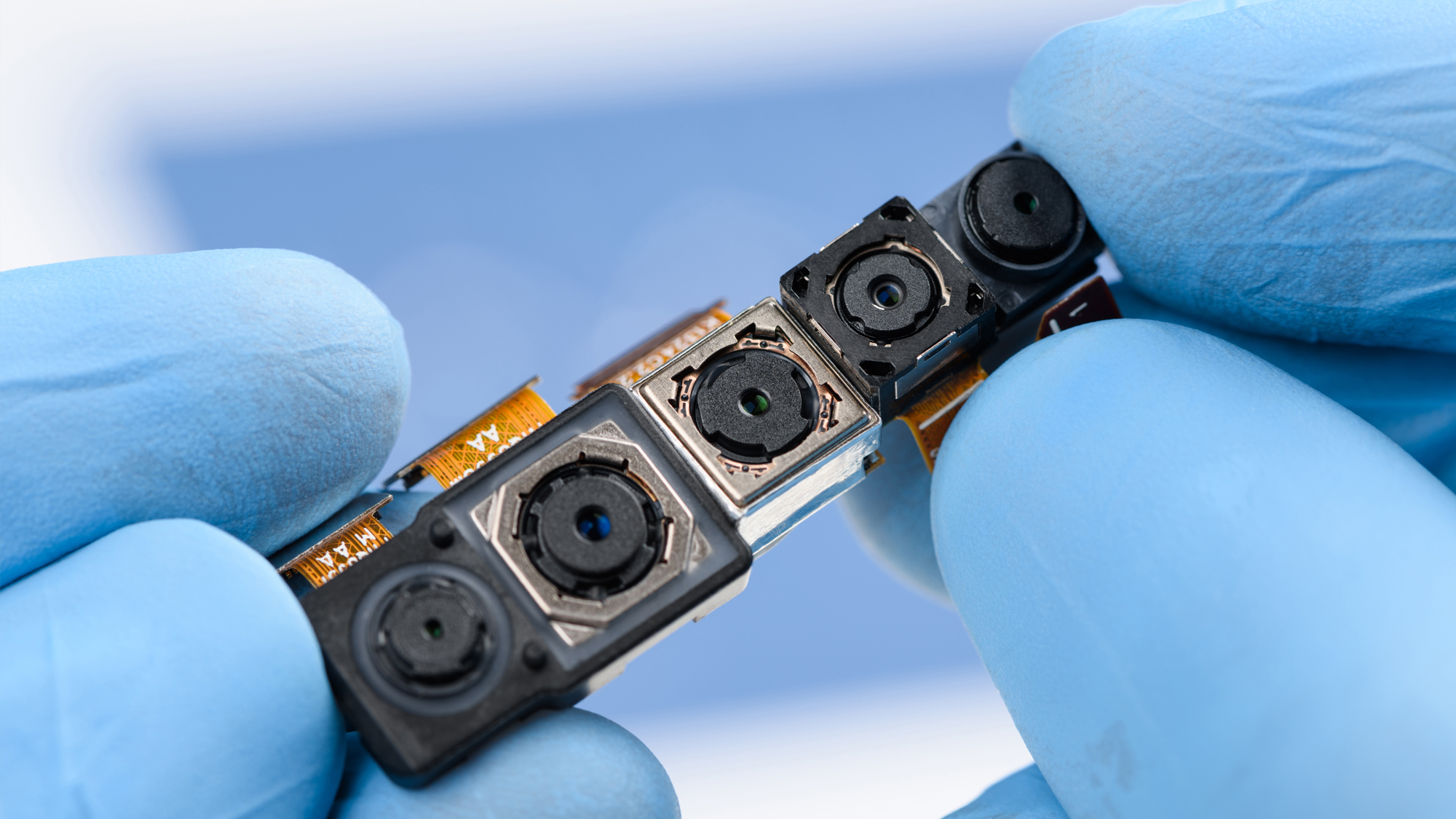

Packaging and Specialty Chips: Chinese firms are investing in advanced packaging (chiplets, 2.5D/3D integration) to maximize performance from mature nodes. For example, HiSilicon’s new chips use innovative packaging to sidestep node limitations. In power electronics, companies like StarPower and BYD Semiconductor are producing IGBTs and SiC/GaN devices for electric vehicles, aiming to localize the supply of these strategic components.

Third-Generation Semiconductors: China considers wide-bandgap semiconductors a priority. Sanan Optoelectronics and others have ramped up production of GaN on Si and SiC wafers. Domestically made SiC MOSFETs and GaN RF chips (for 5G base stations) are increasingly available, reducing reliance on imports for high-speed and high-power applications.

Navigating Sanctions and Self-Reliance

The semiconductor sector has been at the heart of US–China tech tensions. Throughout 2023, the U.S. and its allies expanded export controls to deny China advanced lithography equipment and top-end AI/GPU chips. In response, China doubled down on self-reliance initiatives. The government launched the “Big Fund” Phase III with ¥3440 billion capital in 2024 to invest in domestic chip production and critical equipment. Local governments also offer subsidies, tax breaks, and research grants to chip companies (for example, zero corporate tax for 2–5 years for qualifying IC manufacturers). These policies aim to incubate a fully local supply chain – from chip design EDA tools to fabrication equipment and materials (such as photoresists and silicon wafers).

Beijing has also wielded export control measures of its own. Since mid-2023, China restricted exports of key raw materials (like gallium and germanium) vital to semiconductor manufacturing. In 2024 and early 2025, it added controls on other metals (e.g. silicon carbide inputs, tungsten, etc.). These moves protect national security and signal that China can leverage its dominance in certain mineral supply chains.

For Chinese semiconductor firms, the challenge remains accessing ultra-high-end tools (like EUV lithography) and certain IP. This has somewhat capped leading-edge progress (e.g. mass production of <7nm nodes is limited). However, the industry is adapting by focusing on mature nodes (28nm, 14nm) where it can achieve self-sufficiency, and innovating in chip architecture to maximize performance without bleeding-edge tech.

Impact on Global Buyers and Sourcing

For global procurement teams, Chinese semiconductors are becoming a viable option in more categories. Memory chips, standard MCUs, power devices, sensors, and even mid-range SoCs from China can often meet requirements at competitive cost. Companies like Yangtze Memory (YMTC) are already supplying NAND flash to SSD makers (with performance similar to Samsung or Micron drives). Chinese MCU and logic chip suppliers offer alternatives that can reduce BOM costs, which is especially attractive for cost-sensitive IoT and consumer products.

That said, buyers must consider supply continuity and compliance. Before sourcing advanced Chinese chips, ensure they are not impacted by export restrictions for your country (some U.S. regulations might restrict usage of certain Chinese telecom ICs, for instance). It’s also wise to monitor reliability and support – many Chinese chip firms are young and may not have the same long track record or FAE support overseas as traditional vendors. However, this is quickly changing: more Chinese semiconductor companies are partnering with global distributors and obtaining international certifications.

Call to Action: Keep an eye on China’s semiconductor champions – they are innovating quickly. If you haven’t recently reviewed offerings from Chinese chip suppliers, now is the time. You might find a new source for memory, processors, or power ICs that can diversify your supply chain. Engage with technical teams from these companies (many can communicate in English and offer reference designs) to evaluate their products in your applications. By being open to Chinese semiconductors where they fit, you gain additional sourcing flexibility and potentially lower costs, all while these suppliers continue climbing the technology ladder.